API Price Volatility:What It Is and Why You Should Care

Tânia Marante | Posted on August 29, 2025

Ever wondered why the API market resembles the stock market these days? The answer is simple, and you’ll find it in that David Bowie song Ch-Ch-Changes. In the era of globalization, a big shift in political directions ripples through every industry. After all, every country is dependent on another country for something. Guess what? Pharmaceutical manufacturing is a major industry when it comes to outsourcing outside your own country.

Active pharmaceutical ingredients (API) price volatility refers to these fluctuations in costs. Shifts leads to unpredictably, which in turn leads for scarcity and subsequent behaviors. For procurement professionals in pharma, even modest changes can significantly impact budgets and timelines. Understanding the causes behind these variations are important for more accurate forecasts, stronger supplier negotiations, and ultimately smarter sourcing.

In this blog, we’ll explore the top factors that influence the price and availability of APIs in the global market, why it matters for buyers, recent events that shape the volatility of the now and how companies cope (or should cope) with it to ensure a consistent supply while maintaining competitive prices. But first, let’s explore the main drivers that lead to price volatility.

Table of contents

Main Drivers of API Price Volatility

a) Supply Chain Disruptions & Logistics

Global trade disruptions, pandemic-related delays, and container shortages have repeatedly impacted the delivery of APIs. A key reason is that the global pharmaceutical supply chain is heavily concentrated in just a few regions.

China and India together account for over 80% of the world’s API production. In the United States, more than 60% of APIs are imported from these two countries — with China alone contributing nearly a quarter of total U.S. pharmaceutical imports. Even India, known as the “pharmacy of the world,” relies on China for 70–90% of its key starting materials (KSMs) and APIs for many drugs.

This geographic concentration, paired with logistical fragility, creates significant vulnerabilities. Here’s how:

- Rising fuel and energy costs: Fluctuating oil prices — driven by geopolitics, environmental policy, or speculative markets — directly impact freight rates and manufacturing inputs. For bulk APIs, especially those transported over long distances, this leads to noticeable price increases.

- Labor shortages: From port operators to truck drivers and factory workers, workforce shortages have slowed down production and transport. COVID-19, rising wage expectations, and aging workforces in manufacturing hubs like India and China have added delays and driven up labor costs.

- Logistics bottlenecks: High demand hasn’t been matched by logistics capacity. Congested ports, container shortages, customs delays, and limited air cargo availability all slow down shipments. For time-sensitive APIs, even slight delays can mean spoilage or the need for more costly transport methods.

- Global interdependence: The typical pharma supply chain is long and fragmented — with KSMs sourced in China, APIs produced in India, and buyers in Europe or the U.S. Any disruption along this path — from strikes to export bans or natural disasters — can delay production and delivery. The longer and more global the route, the higher the exposure to risk.

b) Regulatory Shifts & Tariffs

Global pharmaceutical supply are becoming increasingly vulnerable to geopolitical tensions, trade barriers, and export controls. The COVID-19 pandemic made this vulnerability visible on a global scale, showing how quickly such disruptions can compromise access to essential medicines.

In response to shortages, several countries — including India, France, Poland, Greece, Norway, Spain, and Bulgaria have either implemented or threatened export bans to preserve domestic drug reserves. Even when production capacity exists, these restrictions can prevent medicines from crossing borders, creating serious chokepoints in the global supply system.

Trade policies such as tariffs further complicate the picture. New or proposed tariffs on pharmaceutical imports, especially KSMs and APIs, disproportionately affect the generic drug sector, which relies on low-cost inputs to maintain affordability. These added costs can lead to reduced production, fewer market players, and even manufacturer exits from key markets like the U.S., all of which worsen drug shortages and drive up prices.

The impact is especially severe for low-income populations who depend on affordable generics. What begins as a trade policy decision can quickly cascade into reduced access, higher healthcare costs, and more profound inequalities in treatment availability, highlighting the delicate balance between economic policy and public health outcomes.

c) Demand Fluctuations & Seasonal Trends

Demand for certain APIs fluctuates based on disease outbreaks, seasonal trends, and the development of new medications.

The COVID-19 pandemic exposed the fragility of global pharmaceutical supply chains. In the early months of the crisis, widespread drug shortages captured headlines, with a CNBC article on April 4, 2020, famously declaring, “There’s a shortage of everything” — reflecting the situation in hard-hit areas like New York City. While many shortages stemmed from a sudden surge in demand, supply-side issues also played a major role. Over 40 Chinese API manufacturers were shut down due to national lockdowns, and India imposed temporary export bans on 26 essential drugs, including acetaminophen and several antibiotics.

These simultaneous demand and supply shocks were further intensified by the structural rigidity of the U.S. generic drug supply chain. For safety and regulatory reasons, switching to a new API supplier is not a quick process — it typically takes 12 to 15 months for a manufacturer to validate and receive approval for a new source. The process is also expensive, which is why many low-margin generic drugs rely on just one or two approved API suppliers.

In cases where a new API needs to be developed from scratch, the timeline can stretch beyond four years, a significant hurdle, especially when existing overseas suppliers are already producing and the shortage may only last a few months. While the system ensures drug safety and compliance, it lacks the agility needed to respond quickly during crises.

Events like pandemics, the launch of new therapies, or seasonal disease outbreaks (e.g. influenza) can rapidly shift demand and put additional strain on already fragile supply networks — often triggering sharp price increases when supply can’t keep pace.

d) Competition Dynamics & Generic Price Decay

Another dynamic to be considered is the competition one. The level of competition in the market plays a key role in determining API prices. In a highly competitive market, companies that can produce APIs more efficiently and at lower costs often set the pricing standard. However, in the case of high-demand APIs, even intense competition may not prevent price increases.

Following patent expiry, generics enter the market, leading to price drops. Over time, as some manufacturers exit the low-margin markets, prices can bounce back temporarily. Market consolidation further distorts pricing, as fewer competitors can maintain higher margins.

e) Cost-Based Factors & Production Economics

Prices often reflect raw material costs, manufacturing processes, quality compliance, and related overheads. Cost-based pricing remains an industry staple—though it can fall out of sync with market demand or competitive pressures. It involves setting the price of an API based on the production costs plus a margin for profit. Factors considered include:

– Raw Material Costs: Prices of starting materials and intermediates.

– Manufacturing Costs: Costs associated with synthesis, purification, and production processes.

– Quality Control: Expenses for analytical testing, validation, and compliance with regulatory standards.

– Overhead Costs: Administrative, marketing, and distribution expenses.

Why It Matters in the Context of Volatility

While cost-based pricing offers clear advantages, such as:

- Transparency and justification: Buyers can better understand where their money goes, especially for complex or high-quality APIs.

- Price stability during normal market conditions: When markets are calm, this model ensures predictability in procurement and budgeting.

- Alignment with regulatory scrutiny: For government tenders or reimbursement-driven markets, cost transparency supports compliance.

… it also has limitations in volatile markets.

When demand suddenly surges or supply gets restricted (e.g., during a pandemic or geopolitical disruption), cost-based pricing can lag behind real-time market trends. Suppliers may stick to their cost models even as demand would allow higher pricing, or conversely, prices may remain elevated even if market demand has softened, simply because input costs haven’t yet adjusted.

For buyers, understanding the cost structure behind API pricing helps in negotiation, but it must be paired with real-time market intelligence and trade data to avoid overpaying in a volatile environment.

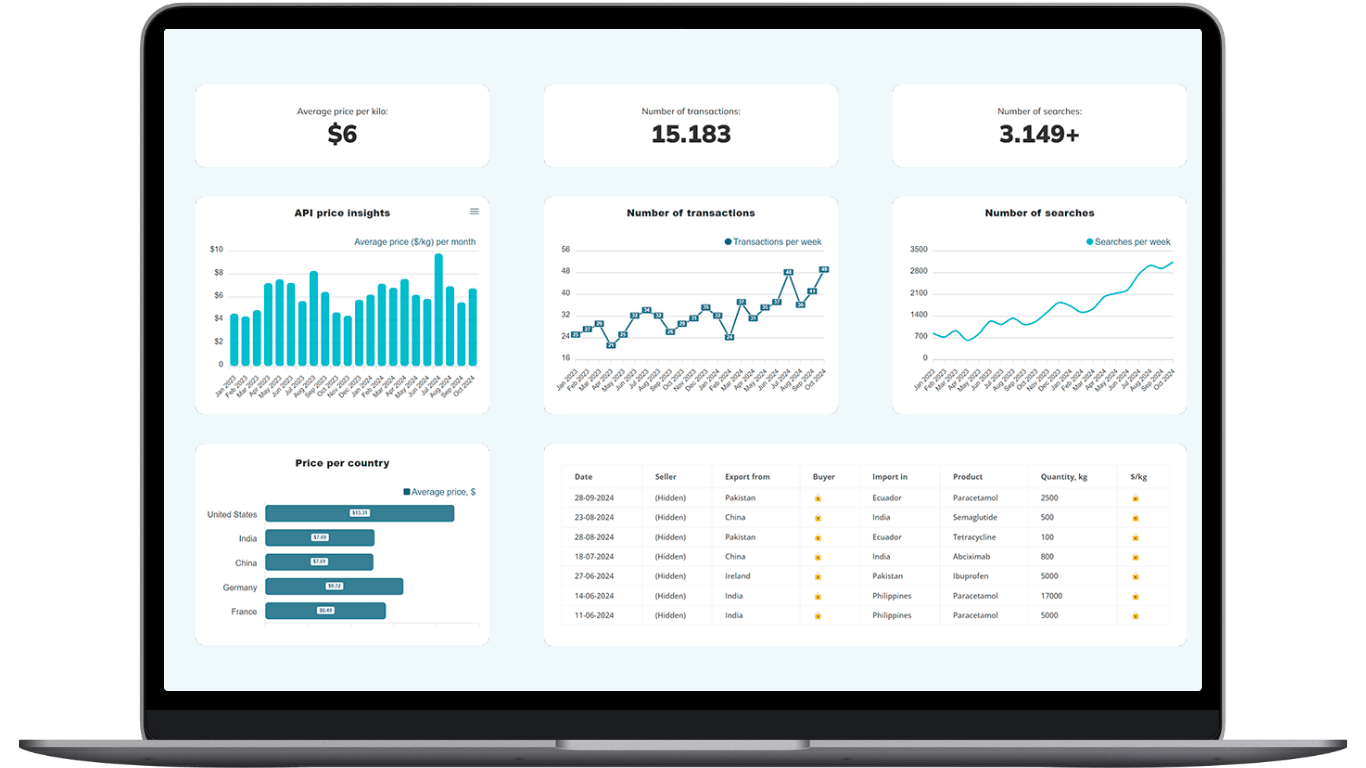

Pharmaoffer equips you with price benchmarks, transaction trends, and supplier insights to negotiate confidently and react strategically. Don’t let volatility catch you off guard. Use data to lead your sourcing decisions.

Make Smarter API Decisions with Data

Access exclusive insights on global API pricing, export/import transactions, competitor activities and market intelligence.

f) Geopolitical & Strategic Risk Factors

Geopolitical tensions, export bans, and supply chain vulnerabilities, especially reliance on China and India, pose risks. The COVID‑19 pandemic spotlighted the fragility of these cross-border dependencies. Countries have responded to shortages and strategic concerns by imposing trade restrictions. For example, policies such as export bans and tariffs on APIs or key starting materials can sharply elevate costs and limit availability.

Why API Price Volatility Matters for Buyers

- Budgeting and Forecasting: Volatility makes it hard to plan and allocate budgets accurately.

- Timing Purchases: Price trends inform when to buy, potentially avoiding peak costs.

- Risk Mitigation: Understanding volatility helps diversify suppliers and avoid single points of failure.

Recent Drivers of Price Volatility

Here’s what’s currently moving API prices in the market:

- The U.S. has implemented tariffs of 25% on APIs from China and 20% on those from India, affecting critical ingredients used in antibiotics, antivirals, oncology medications, and pain management therapies. These measures are already inflating production costs for U.S. manufacturers.

- Drugmaker Granules India (GRAN.NS), posted a 1.6% fall in fourth-quarter revenue on Wednesday, hurt by a decline in paracetamol sales and price erosion. Granules, which focuses on making API, holds 30% of the global market for Paracetamol. It makes the drug’s API as well as the finished dosage – the ready-for-consumption product. The company’s consolidated revenue fell year-on-year to 11.76 billion rupees (nearly $141 million) for the three months to March 31. Glenmark Life Sciences, and Laurus Labs posted lower fourth-quarter profit, signaling market saturation for classes like paracetamol.

- Glenmark’s revenue was also hit by issues stemming from the Red Sea crisis, while multiple factors, including a decline in the selling prices of antiretroviral products challenged Laurus.

- With growing global awareness of environmental sustainability, API manufacturers must comply with stricter environmental regulations. These regulations are designed to minimize the environmental impact of pharmaceutical production, but they often come at a cost. Waste management: Proper disposal of waste generated during the API manufacturing process is crucial, and adhering to stringent waste management regulations can increase operational costs. Sustainable practices: Many companies are investing in greener technologies and practices to reduce their carbon footprint. While these initiatives are important for long-term sustainability, they can raise the short-term costs of API production.

How Companies Can Cope With API Price Volatility

To effectively cope with API price volatility, companies must go beyond reactive sourcing and adopt a multi-layered strategy that builds resilience into their procurement processes. Here we present some of the solutions countries and companies should consider investingin :

Geographic diversification: spreading API sourcing across multiple countries reduces the risk of disruption from any one region, particularly when geopolitical tensions or export bans emerge. Many companies are also embracing friendshoring, deliberately shifting their supply chains to politically stable and allied nations. Government-led initiatives like the EU’s Critical Medicines Act are reinforcing this trend by encouraging local or regional production of essential APIs to safeguard public health.

Strategic partnerships with suppliers: in the context of friendshoring, such as long-term agreements or volume commitments, also help stabilize pricing and availability, especially when demand spikes or inputs become scarce.

Leveraging data for accurate forecasting:: Leading procurement teams are investing in real-time trade data and market intelligence to stay ahead of fluctuations. Access to accurate pricing benchmarks, transaction trends, and supplier histories empowers them to negotiate better deals, time purchases strategically, and avoid the financial shocks of sudden price hikes.

Dual qualification (or diversify to supply) and tech transfer capabilities: companies are investing to maintain regulatory flexibility. While onboarding a second API supplier can take time, but it provides a crucial fallback when a primary supplier faces issues, and can even serve as a bargaining tool during negotiations.

- Risk mitigation: If your main supplier is down, you don’t need to wait a year to validate a new one, you’re already covered.

- Negotiation power: When suppliers know you have an alternative ready, you can negotiate better prices and terms.

- Continuity of supply: Even in a volatile market, production and sales continue without major disruptions.

A good idea is to find a reliable source outside the comfort of your supply chain. Marketplaces like Pharmaoffer give you verified, stable, and worldwide supplier options and other tools you’ll need to evaluate global suppliers, monitor trade activity, and make smarter sourcing decisions, especially in turbulent market conditions.

API price volatility is more than just a market metric—it’s a critical factor that shapes sourcing strategy, supplier partnerships, and procurement success. As volatility rises, the ability to access accurate, timely trade data becomes indispensable.

Reference List

-

Drug Patent Watch “Sourcing Key Starting Materials (KSMs) for APIs” https://www.drugpatentwatch.com/blog/sourcing-the-key-starting-materials-ksms-for-pharmaceutical-active-pharmaceutical-ingredients-apis/

-

ChemAnalyst“Soaring Naproxen API Prices Raise Concerns for Drug Makers and Consumers”https://www.chemanalyst.com/NewsAndDeals/NewsDetails/soaring-naproxen-api-prices-raise-concerns-for-drug-makers-and-consumers-28407

-

NicoVaper“Price and Availability of APIs in the Global Market” https://www.nicovaper.com/blog/price-and-availability-of-apis-in-the-global-market

-

Axios“U.S. Pharmaceutical Supply Chain Is in Crisis, Experts Say”https://www.axios.com/2025/05/30/axios-event-domestic-pharmaceutical-supply-chain

-

LGM Pharma “Tariffs & API Supply Chain Resilience in 2025” https://lgmpharma.com/blog/tariffs-api-supply-chain-resilience-in-2025/

-

CEN (Chemical & Engineering News) “Indian Drugmakers Worry About U.S. Tariffs” https://cen.acs.org/policy/trade/Indian-drugmakers-worry-tariffs/103/web/2025/08

-

Times of India “US Tariff Heat: Indian Pharma Sector Seen at Risk” https://timesofindia.indiatimes.com/business/india-business/us-tariff-heat-fitch-says-indian-firms-face-limited-direct-hit-pharma-sector-seen-at-risk-if-duties-widen/articleshow/123388751.cms

-

Reuters “India’s Contract Drug Makers Seek Support to Compete With China” https://www.reuters.com/business/healthcare-pharmaceuticals/indias-contract-drug-makers-seek-government-support-china-fight-2025-02-27/

-

Reuters “EU Announces Plans to Cut Reliance on Asia for Critical Medicines” https://www.reuters.com/business/healthcare-pharmaceuticals/eu-announces-plans-cut-reliance-asia-antibiotics-other-critical-drugs-2025-03-11/

-

Wikipedia “Friendshoring” https://en.wikipedia.org/wiki/Friendshoring

-

Pharma’s Almanac “Building Resilient Pharma Supply Chains in an Uncertain World” https://www.pharmasalmanac.com/articles/building-resilient-pharma-supply-chains-in-an-uncertain-world

-

AZO Life Sciences “What Will It Take to Build True Resilience in Pharma Supply Chains?” https://www.azolifesciences.com/article/Pharma-Supply-Chains-in-2025-What-Will-It-Take-to-Build-True-Resilience.aspx

-

Cognitive Market Research “How 2025 U.S. Tariffs Are Reshaping Global Pharma Supply Chains” https://www.cognitivemarketresearch.com/blog/how-2025-u-s-tariffs-are-reshaping-global-pharma-supply-chains

-

Wikipedia “Generic Pharmaceutical Price Decay” https://en.wikipedia.org/wiki/Generic_pharmaceutical_price_decay

-

Wikipedia “Prescription Drug Prices in the United States” https://en.wikipedia.org/wiki/Prescription_drug_prices_in_the_United_States

-

Reuters “Granules India Posts Revenue Fall on Weak Paracetamol Sales, Price Erosion” https://www.reuters.com/business/healthcare-pharmaceuticals/granules-india-posts-q4-revenue-fall-weak-paracetamol-sales-price-erosion-2024-05-15/

-

The Pharma Master “API Pricing Strategies” https://www.thepharmamaster.com/api-pricing-strategies

-

API Center (HDA Research Report) “The U.S. API Infrastructure Report” https://apicenter.org/wp-content/uploads/2024/07/The-US-Active-Pharmaceutical-Ingredient-Infrastructure.pdf

-

arXiv.org“Pharmaceutical Supply Chain Resilience Under Policy and Market Risk”https://arxiv.org/abs/2308.07434

What is API price volatility?

It’s the fluctuation in API prices over time, driven by logistics costs, regulatory/tariff changes, demand spikes, and supplier concentration.

What are the main causes of API price volatility?

Supply-chain bottlenecks (fuel, labor, ports), geopolitical actions (tariffs/export bans), demand swings (seasonal/health events), and input/production costs.

How does trade data help buyers negotiate better API prices?

By revealing average market prices, recent transactions, and active buyer/seller lanes so you can benchmark quotes, time purchases, and justify counter-offers.

How can companies mitigate API price volatility?

Diversify suppliers and geographies (incl. friendshoring), use real-time trade data, set long-term terms with strategic partners, and qualify multiple API sources.

What recent factors are pushing API prices up?

Higher fuel and freight costs, labor shortages, port congestion, and new/proposed tariffs on KSMs/APIs—plus episodic demand surges for specific therapies.

Check out all other blogs here!