Discover the biggest pharma market trends in 2030, the role of AI and supply chain changes to equip your business and navigate the next decade in pharma.

- Introduction

- Therapy Growth Areas in the Pharmaceutical Industry

- Data-Driven Innovation: AI in Pharmaceutical Industry

- API and Pharmaceutical Supply Chain Resilience

- The Rise of Trade Data for Pharmaceutical Sourcing

- Sustainable Pharmaceutical Sourcing

- The Pharma Industry of 2030: Where Are We Headed?

Introduction

Do you ever get the sense that things are evolving too quickly? It seems like yesterday, AI was something exotic and distant, something of the future, and now you can’t scroll through your phone without bumping into AI this and AI that. So what does the future hold now? Is AI still the future? What are the main trends that are going to shape not just the next few years but the next decade?

In this global village we live in, businesses and sectors are affected by every major change, even if it’s happening on the other side of the world. In pharma, like every other industry, it’s like this.

Beyond scientific innovation, it’s becoming apparent the pharmaceutical industry is dealing with supply chain resilience challenges, trade restrictions, etc. As geopolitical tensions influence API sourcing strategies and governments enforce stricter environmental regulations, pharma leaders must find new solutions to sourcing, pricing, and production.

This article explores what specialists list as the top three forces shaping the future of pharma. From therapy area growth to AI-driven transformation and supply chain evolution, we provide insights into how companies can stay competitive in this new era. Let’s get into it.

Therapy Growth Areas in the Pharmaceutical Industry

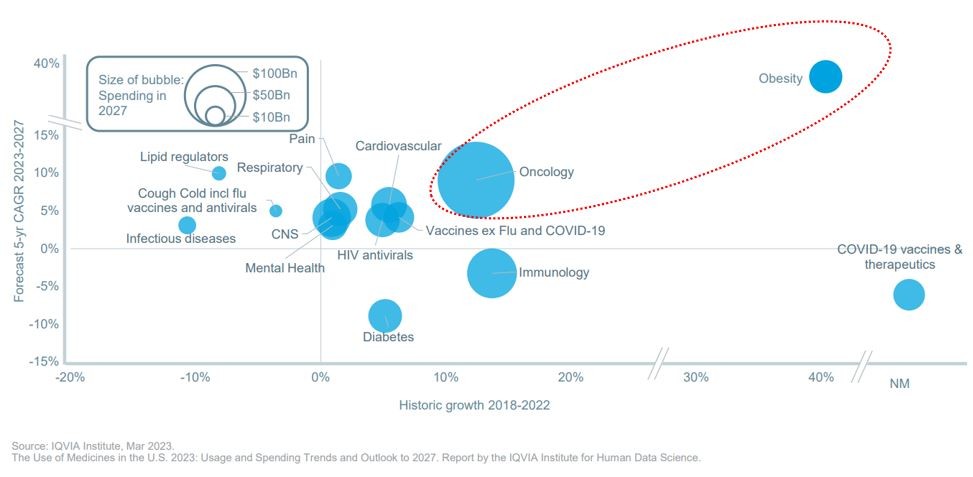

Certain therapy areas are experiencing rapid growth, attracting significant investments and R&D efforts. By 2030, oncology, immunology, and metabolic diseases (including obesity and diabetes treatments) are expected to dominate the market.

Oncology Drug Market 2030

Oncology makes up a significant proportion of global healthcare spending, so it is not surprising that it is also the leading growth therapy area. Cancer is the second most common cause of death in places like the US and EU, behind heart disease, and is the leading cause of death in places like Japan. Eurostat The increase in cancer cases can be attributed to several factors, including the aging population in high-income countries and a general decline in deaths from other causes, such as cardiovascular disease. Because of this growth, it is only natural to have a lot of investment focused on cancer research and development, leading to the launch of innovative therapies.

In terms of numbers, the generic drug market for oncology is projected to surpass $377 billion by 2030 Statista, charged by innovation in targeted therapies, cell & gene treatments, and immuno-oncology NCBI. Checkpoint inhibitors, CAR-T therapies, and personalized cancer drugs lead this transformation, offering more effective and tailored treatments NCI.

Immunology Drug Pipeline growth

This is the second-largest growing therapy area, reaching $166 billion globally in 2024 at ex-manufacturer prices. However, it is essential to differentiate the growth prospects of the autoimmune ~4% CAGR (till 2027) vs. inflammation market, which is expected to grow at 3-4 times that rate, i.e., 12-15% CAGR, over the same period according to projections like IQIVIA.

For better understanding, the split between therapy areas happens because the first generation of autoimmune treatments is reaching maturity, with key therapies losing exclusivity. The arrival of biosimilars for widely used therapies like leading brand Humira in the U.S. will likely offer cheaper options, especially in conditions like rheumatoid arthritis, IBD, and psoriasis. This shift will lower overall prices and impact treatment choices as payers prioritize biosimilars for early-stage treatments. As a result, newer, innovative therapies may be used later in treatment sequences.

At the same time, all major autoimmune indications face extensive crowding as the next wave of innovation is fighting for position, intensifying inter- and intra-class competition as therapy options proliferate.

Obesity and Diabetes Market Forecast

Once an overlooked market, obesity and diabetes are seeing rapid expansion due to groundbreaking treatments. 2013 was a turning point for obesity, given that the World Health Organization recognized it as a chronic disease requiring long-term management. Since then, new therapies have expanded the market, creating growth opportunities in diabetes and obesity care.

It is well known that new weight-loss drugs have transformed patient outcomes, leading to increasing demand. We all live in Ozempic times, but this medication overlaps with diabetes management, bringing supply challenges while also offering dual benefits. Innovation in GLP-1 receptor agonists (such as semaglutide and tirzepatide) and next-generation therapies are driving significant interest from healthcare providers and payers.

At this moment, obesity drugs are projected to grow into an $85 billion industry by 2030. GLP-1 drugs, initially developed for diabetes, are now driving a pharmaceutical boom in weight management, expanding treatment options for millions worldwide.

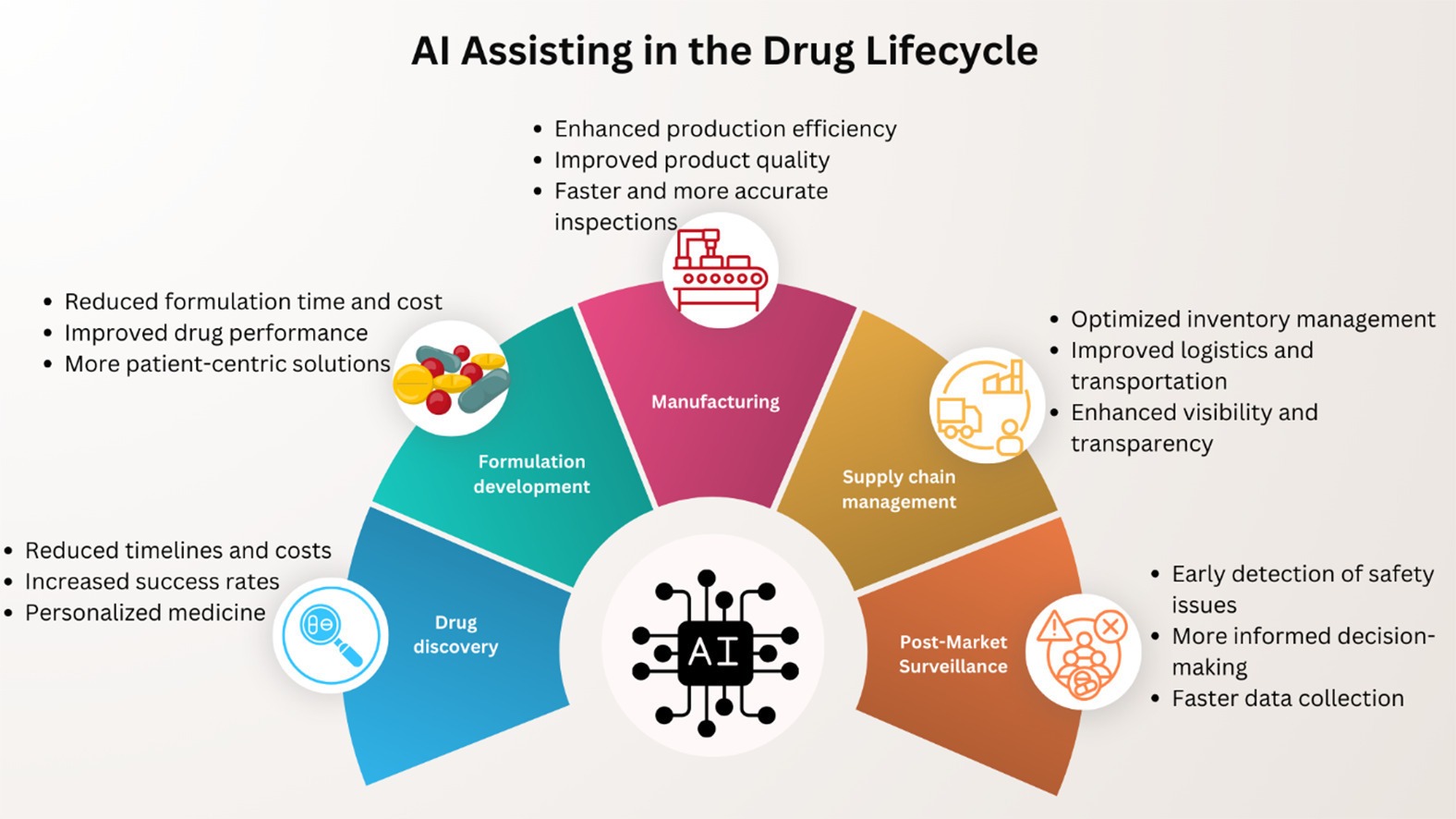

Data-Driven Innovation: AI in Pharmaceutical Industry

The pharma industry is undergoing a digital transformation, with AI, machine learning, and predictive analytics playing an increasing role in R&D, clinical trials, and market intelligence. Data digitalization is transforming every sector, including the pharmaceutical industry, as a front-runner beneficiary.

AI in Drug Discovery and Development

According to a study from the National Center for Biotechnology Information (NCBI), AI is already improving the life cycle of products and is predicted to range advances from drug discovery to product management. Besides making systems and processes more simple and seamless, there are significant challenges in acquiring, scrutinizing, and applying that knowledge to solve complex clinical problems.

AI is reducing drug discovery timelines from years to months. The tools it uses in drug discovery involve domains like reasoning, machine learning (ML), and deep learning (DL). DL uses artificial neural networks (ANNs) that mimic human brain neurons for pattern recognition and complex problem-solving. Key ANN types include multilayer perceptron (MLP) for supervised pattern classification, recurrent neural networks (RNNs) for memory tasks, and convolutional neural networks (CNNs) for image and biological system processing. Advanced AI tools, like IBM Watson, apply these technologies for medical data analysis, enabling rapid disease detection and personalized oncology treatment strategies Pharmaceutical Journal.

Companies like Insilico Medicine and BenevolentAI have already identified new drug candidates using AI-driven platforms, revolutionizing their development pipeline, so this is just the beginning of an acceleration and true industry/product revolution.

Source: Science Direct

Predictive Analytics in Pharma

Predictive analytics uses historical data, statistical algorithms, and machine learning techniques in the pharmaceutical industry to determine the likelihood of future outcomes based on past information. It can forecast demand, optimize inventory levels, and even anticipate potential disruptions in the supply chain.

The bottom line is that companies can make informed decisions from now on, such as knowing which products to invest more effort and budget in to enhance their business’s efficiency and effectiveness, all by analyzing large datasets.

How do different businesses benefit from Predictive Analytics?

- Businesses can reduce costs by strategically determining the most profitable sourcing options, ensuring a steady supply of high-quality APIs.

- Stay ahead of the competition by proactively adjusting their strategy to meet evolving customer needs and capitalize on new opportunities before others.

Platforms that track API price trends, trade data, and transaction volumes represent a significant breakthrough in decision-making. With such transformative potential, this technology is here to stay as a driver for better patient care, stronger stakeholder confidence, and a more efficient pharmaceutical supply chain.

Personalized Medicine and Real-World Data (RWD)

Personalized medicine, also known as precision medicine, is a rapidly evolving medical approach that seeks to personalize healthcare by taking into account a patient’s unique characteristics at molecular, physiological, ecological, and behavioral levels Science Direct.

If we consider an individual’s unique molecular, physiological, ecological, and behavioral characteristics, personalized medicine is the foundation of this integration. By leveraging AI and machine learning, healthcare professionals can analyze large and complex datasets generated by pharmacogenomics, enabling them to predict drug responses and tailor treatment plans to each patient’s genetic makeup.

It is, in its essence, this way to tailor the treatment on an individual level with precision rather than using a one-size-fits-all approach. Technological advances, such as DNA proteomics, imaging protocols, and wireless health monitoring devices, have contributed to significant improvements in personalized medicine.

Much more to come till 2030

There are still challenges to overcome, like the need for more relevant models based on human cell cultures and the personalization of therapy, as mentioned in Taherdoost & Ghofrani’s study. However personalized medicine holds immense promise in revolutionizing the healthcare field and transforming patient care by offering personalized and targeted therapies that improve health outcomes and enhance the quality of life.

The application of AI in pharmacogenomics can also contribute to developing novel drugs and medical devices. This integration represents a significant advancement in the field of personalized medicine, offering the promise of more effective, tailored treatments and reduced healthcare costs.

API and Pharmaceutical Supply Chain Resilience

The global API market is undergoing a fundamental shift as pharmaceutical companies navigate new trade barriers and sourcing challenges. The resurgence of U.S. protectionist policies, particularly the latest tariffs on API imports CNBC, might force drug manufacturers to rethink their supply chain strategies.

US API Tariffs Impact Pharma

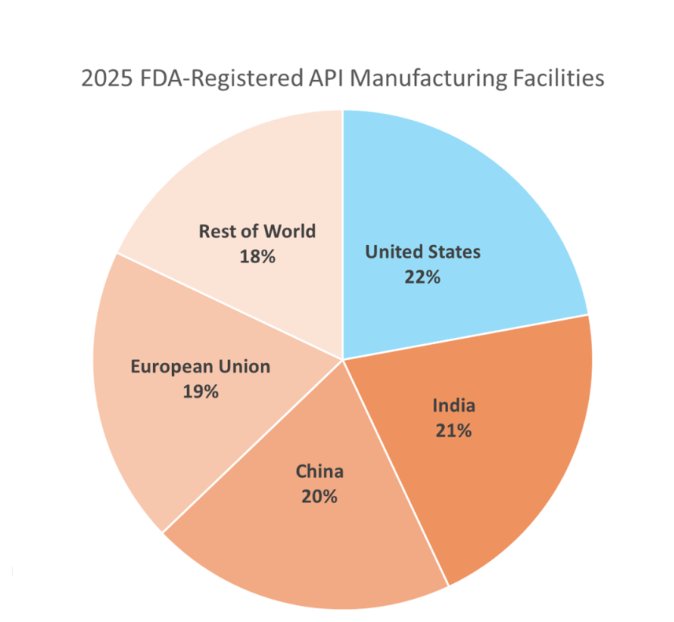

The United States is the largest pharmaceutical market, importing $178 billion worth of pharmaceutical products in 2023 and totaling 22% of the global market for pharmaceutical import Comtrade. Its heavy reliance on offshore API manufacturing, especially in China (20% of FDA-registered API facilities) and India (21%), has created strategic vulnerabilities.

Source: LGM Pharma

To address these concerns, the new US government has intensified tariffs on Chinese pharmaceutical imports, with duties reaching 35% on key pharmaceutical raw materials, intermediates, and APIs as of February 2025. Additionally, new tariffs on EU-based pharmaceutical imports have been signaled, raising alarms across European manufacturers.

In response to escalating trade tensions and increased import costs, pharmaceutical companies are implementing two key strategies:

- Reshoring API Manufacturing:

The U.S. is pushing for onshore API production, encouraging domestic manufacturing to reduce dependency on foreign suppliers. This shift, however, is met with economic challenges, as U.S. production costs remain significantly higher than those in China and India. - Diversifying Supplier Networks:

Companies are exploring alternative sourcing options in India, Southeast Asia, and Europe to mitigate risk. However, as LGM Pharma highlights, India still relies on China for 70% of its bulk drug intermediates, meaning indirect exposure to tariffs remains challenging.

The Challenge of Onshoring: Costs vs. Capacity

While U.S. protectionist policies aim to boost domestic API manufacturing, industry leaders warn of significant hurdles:

- Long Lead Times for New U.S. API Plants: Scaling up domestic API manufacturing requires years of investment before facilities reach full operational capacity.

- Higher Production Costs: Even with tariffs, China’s cost advantages remain unmatched, making it difficult for U.S. manufacturers to compete on price.

- Regulatory Approvals: Transitioning API suppliers requires FDA re-approvals, increasing costs and delays for pharma companies looking to shift manufacturing.

Impact of Protectionist Policies on Pharma

Many European and U.S. pharmaceutical companies have formed “tariff taskforces” to prepare for potential new levies on drug imports. Major pharma manufacturers, including Fresenius Medical Care and Pfizer, are reassessing their global supply chains to mitigate risks from new trade restrictions.

While some U.S. firms relocate production domestically, others opt for a hybrid strategy, maintaining some offshore sourcing while stockpiling critical APIs to hedge against future tariffs.

The Rise of Trade Data for Pharmaceutical Sourcing

With the rise of digital platforms offering insights into API pricing, transaction volumes, and global sourcing trends, procurement teams can make faster, more informed decisions. In our current political and economic climate, there are enough risks as it is and betting on the right chip is not just a good move but an essential one to keep businesses alive and mitigate risks associated with supply chain volatility. Therefore, access to real-time trade data is becoming a necessary tool for all pharma companies.

AI-driven decision-making: Benefits for API Buyers & Pharmaceutical Manufacturers

API buyers and suppliers benefit immensely from knowing and understanding trading data on their products for different reasons. Let’s break it down with two examples:

- A generic drug manufacturer sourcing Ibuprofen API discovers that a recent tariff implementation has driven up prices in certain regions where they do business. By accessing the trade data through business intelligence tools on that API, they can identify alternative suppliers in new markets with better prices, securing a stable supply. Similarly, a pharmaceutical sourcing team can detect early signs of price inflation for their API and adjust inventory strategies accordingly.

API manufacturers and traders also benefit from trade insights to refine pricing strategies, expand their client base, and improve market positioning.

- For example, a European API manufacturer specializing in semaglutide could use trade data to discover that competitor exports to Latin America have increased significantly in the past year. By maximizing this intelligence, the supplier can proactively target buyers in that region, adjusting its pricing to capture market share.

Access exclusive insights on global API pricing, export/import transactions, competitor activities and market intelligence.

Sustainable Pharmaceutical Sourcing

As governments worldwide tighten environmental and compliance regulations, pharmaceutical companies must adapt their API sourcing strategies to meet evolving sustainability standards. Regulatory bodies, including the U.S. FDA, EMA, and China’s NMPA, impose stricter environmental controls on API manufacturing, leading to cost increases, supply chain adjustments, and a growing demand for greener production methods.

Sustainable Pharmaceutical Sourcing in API Supply Chains

The pharmaceutical industry is among the largest consumers of solvents, water, and energy, making it a focal point for environmental scrutiny. Governments are cracking down on high-pollution manufacturing facilities, particularly in India and China, where a significant portion of global API production occurs.

For example:

In China, stringent environmental policies: such as the Blue Sky Protection Campaign, have forced the closure of non-compliant API plants, disrupting global supply chains. In Europe, the EU Green Deal and REACH regulations are pushing API manufacturers toward low-carbon and waste-reducing production techniques.

These policies directly impact API buyers, who must now factor environmental compliance into their sourcing decisions to ensure supply continuity.

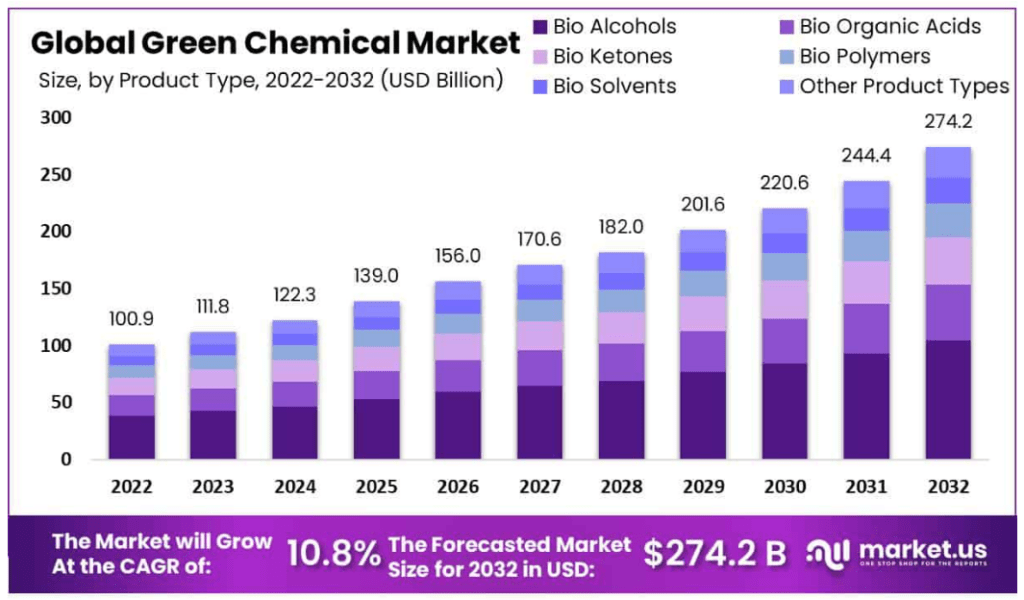

Green Chemistry & Sustainable API Manufacturing in 2030

To stay competitive in a rapidly evolving regulatory landscape, API manufacturers are adopting green chemistry principles besides sustainable pharmaceutical sourcing, which emphasize:

Solvent Recovery & Waste Reduction: Reducing hazardous solvent use and implementing circular supply chains to minimize environmental impact.

Energy-Efficient Production Methods: Utilizing continuous manufacturing to cut carbon emissions and lower costs.

Biocatalysis & Enzyme-Based Synthesis: Replacing traditional chemical processes with biological catalysts to create more eco-friendly and scalable APIs.

Example: A shift in production toward bio-based feedstocks instead of petroleum-derived intermediates is already happening in places like Europe.

Source: Market.us

The Pharma Industry of 2030: Where Are We Headed?

While we can’t predict the future with absolute certainty, one thing is clear: companies that proactively invest in learning and adapting to what’s likely to happen in the foreseen future will make smarter decisions and capitalize ahead of others.

So those who invest in learning, refining their sourcing strategies, and staying ahead of industry shifts will be best positioned to thrive. Adaptability here is the defining factor for success.

References:

https://pmc.ncbi.nlm.nih.gov/articles/PMC9790040/

https://www.cancer.gov/about-cancer/treatment/research/car-t-cells

https://www.jpmorgan.com/insights/global-research/current-events/obesity-drugs#section-header#1

https://pharmaceutical-journal.com/article/feature/how-ai-is-transforming-drug-discovery

https://lgmpharma.com/blog/tariffs-api-supply-chain-resilience-in-2025/