China’s Pharma Giants:

10 Companies You Should Know

Nancy Cao | Posted on September 22, 2023

Introduction

Did you know China is rapidly becoming the epicenter of global pharmaceutical innovation? Not just a manufacturing hub, China is now a breeding ground for pharma excellence and ingenuity. If you’re an API supplier or a pharmacist, you can’t afford to overlook this dynamic market. So, what’s the big deal? Stick around as we delve into the 10 biggest pharma companies making waves in China.

Why China?

Growing Market

Why is the world turning its gaze toward the pharmaceutical landscape in China? For starters, China’s pharmaceutical market is expected to be worth over $160 billion by 2024. That’s huge, right?

Regulatory Reforms

The China Food and Drug Administration (CFDA) has been rolling out regulatory reforms like they’re going out of style. It’s all part of the plan to put China on the pharmaceutical map, globally speaking.

API Sourcing Hub

China accounts for a significant proportion of global API production. In fact, up to 80% of the APIs used in the United States are sourced from China and India. So, if you’re in the API business, this is where the action is.

Criteria for Ranking

Before diving into the list of companies, let’s clarify the yardsticks we’re using. We’re not picking names out of a hat, you know!

Revenue

Money talks. Our first criterion is the annual revenue of each company. It’s the easiest way to measure success, but it’s not the be-all and end-all.

Market Share

Size matters, but so does influence. A company’s market share in its particular niche is a critical indicator of its clout.

Innovations

Are these companies one-trick ponies or pharma innovators? We’re giving points for a strong pipeline of products and cutting-edge R&D initiatives.

Make Smarter API Decisions with Data

Access exclusive insights on global API pricing, export/import transactions, competitor activities and market intelligence.

Sinopharm

Brief Overview

Sinopharm is a giant in China’s pharmaceutical landscape, boasting revenues upwards of $40 billion. Founded in 2003, it has quickly grown to become a leader in biopharmaceuticals and healthcare services.

API Specialties

Sinopharm excels in a variety of sectors, from vaccines to generic drugs. With a strong emphasis on quality and innovation, they’re a go-to source for a broad range of APIs.

Market Presence

Sinopharm isn’t just a household name in China. With a presence in multiple countries, they’re a global powerhouse in the pharmaceutical sector.

Fosun Pharma

Brief Overview

Fosun Pharma is another leading pharmaceutical company in China, with annual revenues around $3.5 billion. They’ve been a force to reckon with since 1994.

API Specialties

If you’re looking for API supplies related to anti-infectives, central nervous system drugs, or anti-diabetic agents, Fosun Pharma has you covered.

Market Presence

Fosun Pharma’s market presence extends far beyond China’s borders. They have numerous international partnerships and a solid global strategy.

CSPC Pharmaceutical Group

Brief Overview

CSPC is a Hong Kong-listed company but a major player in China’s pharmaceutical industry. With revenues around $5 billion, they are a significant presence in the market.

API Specialties

CSPC specializes in vitamin C APIs but also has a portfolio covering antibiotics and cardiovascular drugs.

Market Presence

They have a widespread distribution network across China and have started making inroads internationally.

Sino Biopharmaceutical

Brief Overview

Another Hong Kong-listed company, Sino Biopharmaceutical, has significant operations in mainland China. With revenues nearing $3 billion, they focus primarily on R&D for new medicines.

API Specialties

The company has a strong emphasis on hepatitis and oncology medication APIs, among other therapeutic categories.

Market Presence

They’re one of the leading pharma companies in China, with a burgeoning presence in other Asian markets.

Jiangsu Hengrui Medicine

Brief Overview

Jiangsu Hengrui Medicine, with a revenue of around $2.5 billion, specializes in antineoplastic, surgical, and contrast agents.

API Specialties

The company is a leading supplier for APIs related to anesthesia and antineoplastic drugs.

Market Presence

Their footprint is predominantly domestic, but they’re looking to expand internationally.

Zhejiang Hisun Pharmaceutical

Brief Overview

Zhejiang Hisun Pharmaceutical is one of China’s top pharmaceutical companies, boasting revenues of around $1 billion.

API Specialties

The company has made a name for itself in antiviral and anti-infection APIs, but it’s also quite diversified, offering a broad range of products.

Market Presence

Hisun has a strong domestic presence and has been making headway in international markets, particularly in Southeast Asia and Africa.

Livzon Pharmaceutical Group

Brief Overview

Livzon is another heavyweight, with a revenue nearing $1 billion. The company specializes in bio-pharmaceuticals and endocrine medications.

API Specialties

Their APIs cover reproductive health, endocrine regulation, and anti-infection treatments.

Market Presence

Although largely focused on the domestic market, Livzon is gradually expanding its overseas footprint.

Shandong Weigao Group

Brief Overview

Shandong Weigao Group specializes in medical devices, but it’s also a significant player in the Chinese pharma industry. Their annual revenue is approximately $900 million.

API Specialties

The company is a leading supplier for blood purification and orthopedic APIs, making them unique in the Chinese landscape.

Market Presence

Most of their market share is domestic, but they’re eyeing expansion into international markets.

Guangzhou Pharmaceuticals

Brief Overview

A subsidiary of Guangzhou Pharma Holdings, Guangzhou Pharmaceuticals has a revenue of around $700 million. They focus primarily on TCMs (Traditional Chinese Medicines).

API Specialties

The company specializes in APIs derived from natural sources and is a leading supplier of traditional Chinese medicine APIs.

Market Presence

Their focus is mainly domestic, with a few international collaborations in the works.

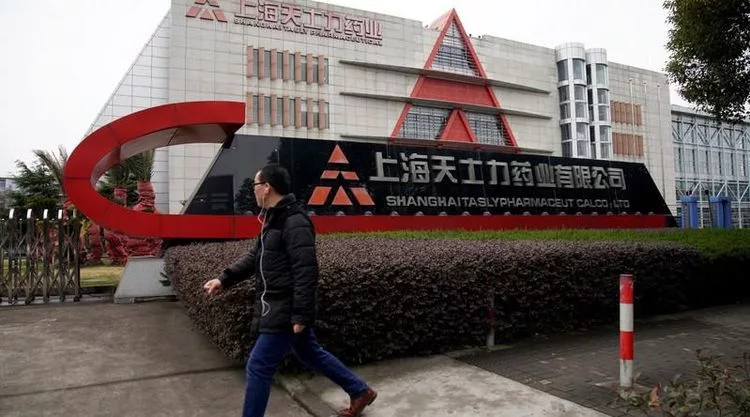

Tasly Pharmaceuticals

Brief Overview

Last but not least, Tasly Pharmaceuticals. With a revenue of approximately $600 million, they specialize in modern TCMs and biological medicines.

API Specialties

Their API portfolio is diverse, including cardiovascular and cerebrovascular medications.

Market Presence

Tasly has a robust domestic presence but is also active in various international markets.

Conclusion

China’s pharmaceutical industry is booming, and these companies are at the forefront. From giants like Sinopharm to specialized firms like Tasly Pharmaceuticals, they collectively form the backbone of China’s pharma market. Whether you’re an API supplier or a pharmacist, keeping tabs on these companies can offer invaluable insights and opportunities.

As we’ve seen, China plays an enormous role in global API production. But what does this mean for other parts of the world? For a deeper dive into the complexities of this relationship, particularly concerning Europe, we invite you to read our related article: “How dependent is the European pharma supply chain on China?”.

So, who’s going to be the next pharma giant from the Middle Kingdom? Only time will tell, but these ten are definitely the ones to watch.

FAQ

Which China company is the largest by revenue?

Sinopharm takes the crown with revenues upwards of $40 billion.

Are these companies active internationally?

Many of these companies, like Sinopharm and Fosun Pharma, have a robust international presence, while others are gradually expanding their global footprint.

What should API suppliers consider when choosing a partner from this list?

Consider the company's market presence, API specialties, and reputation for quality and innovation.

Check out all other blogs here!