Fundamentals of the:Pharmaceutical Supply Chain

Alexander Doroshenko | Posted on July 08, 2025

How do raw materials become medicines? Discover the pharmaceutical supply chain’s stages, challenges, and how technology makes it more resilient.

Table of contents

Introduction

The pharmaceutical supply chain spans a complex journey from raw material sourcing and drug manufacturing to distribution networks and, ultimately, dispensing to patients. Each stage requires stringent quality assurance measures and strict regulatory compliance to ensure that medicines remain safe and effective from factory to pharmacy.

An ineffective supply chain can disrupt patient care and public health, so careful coordination among all stakeholders is critical. This article provides an overview of the key stages of the pharma supply chain, highlights major challenges – from cold chain logistics to counterfeit prevention – and examines how emerging supply chain technology (like digital traceability and automation) is enhancing visibility and resilience in the industry.

From Raw Materials to Patients: Stages of the Pharmaceutical Supply Chain

In the pharmaceutical industry, a medicine’s journey involves multiple stages and players working together. The fundamental stages and stakeholders include:

- Raw Material Suppliers: Every medicine begins with raw materials – notably active pharmaceutical ingredients (APIs) and excipients. Specialized chemical and biotech suppliers provide these building blocks under tight quality standards. Pharmaceutical companies often source APIs globally, making supplier reliability and certification vital.

- Drug Manufacturers: Manufacturing firms (including in-house producers or contract development and manufacturing organizations, CDMOs) convert raw ingredients into finished pharmaceutical products. This includes formulation (mixing APIs with other ingredients), processing into dosage forms (like tablets, injectables), and packaging. Manufacturers must follow Good Manufacturing Practices to ensure each batch meets quality and safety specifications before release. After production, manufacturers distribute drugs either to their own logistics centers or directly to wholesalers and large pharmacies.

- Wholesalers and Distributors: Wholesale distributors act as the central link between manufacturers and dispensing outlets. They purchase pharmaceuticals in bulk, store them in warehouses, and transport them to pharmacies, hospitals, or clinics as needed. Leading wholesalers (for example, McKesson, AmerisourceBergen, and Cardinal Health in the US) handle thousands of products, using sophisticated logistics systems to manage inventory and delivery schedules. Distributors must comply with Good Distribution Practices to maintain drug quality – for instance, keeping medicines in the right conditions during storage and transit.

- Pharmacies and Healthcare Providers: Pharmacies (retail drugstores, mail-order services, hospital pharmacies) and dispensing clinics are the final step before medicines reach patients. They receive products from wholesalers or manufacturers and are responsible for storing them properly and dispensing them safely to consumers. Pharmacists also double-check doses, provide usage instructions, and serve as an information link back to the supply chain. Hospitals and clinics similarly manage on-site inventories for patient care. This last “mile” of the supply chain is crucial – if the right medicines do not reach patients in time and in good condition, the entire chain fails its purpose.

Each of these stages is supported by additional stakeholders. Regulators oversee compliance at every step, shipping companies provide transportation, and in some markets pharmacy benefit managers (PBMs) handle pricing and insurance aspects. All participants must coordinate closely so that medicines reliably go from raw materials to patients without delay or quality issues. Successful delivery of pharmaceuticals “smoothly and efficiently” depends on strong partnerships among manufacturers, distributors, and pharmacies.

Quality Assurance and Regulatory Compliance at Every Step

Given the high stakes for patient safety, quality assurance and regulatory compliance are embedded throughout the pharmaceutical supply chain. Regulatory agencies like the U.S. FDA and European EMA enforce rigorous standards to ensure product quality, efficacy, and integrity from production through delivery. Manufacturers follow Good Manufacturing Practice (GMP) guidelines, which mandate controlled processes, thorough testing, and detailed documentation for every batch produced. Adhering to GMP minimizes risks of contamination, formulation errors, or substandard products, thereby protecting patients and maintaining trust.

Likewise, distributors and logistics providers adhere to Good Distribution Practice (GDP) standards to preserve product quality in transit. Compliance with GDP ensures medicines are stored and transported under the right conditions (e.g. correct temperature and humidity), that contamination or mix-ups are avoided, and that accurate records are kept for traceability. By following GDP guidelines, distributors mitigate risks like product degradation, diversion, or tampering during distribution, so that only safe and effective medicines reach end users.

Quality control checks are performed at multiple points: raw materials are inspected before use, finished products are tested in laboratories, and packaging is checked for correct labeling and sealing. In addition, many countries require serialized tracking codes on each medicine unit. For example, the U.S. Drug Supply Chain Security Act (DSCSA) mandates an electronic system to identify and trace prescription drugs at the package level as they move through the supply chain. This kind of end-to-end traceability helps quickly detect and remove any harmful or counterfeit products, reinforcing quality assurance beyond the factory floor. Overall, a culture of quality and compliance at every stage – backed by audits and regulatory oversight – is fundamental to maintaining product safety and public health.

Challenges: Cold Chain and Counterfeit Prevention in Distribution

Operating a pharmaceutical supply chain comes with specialized challenges that other industries may not face. Two of the most critical are maintaining the cold chain for temperature-sensitive drugs and preventing the entry of counterfeit or substandard medicines.

Temperature-Controlled Logistics (Cold Chain): Many vaccines, biologics, and other sensitive medications must be kept within a narrow temperature range (often 2–8°C, or even below freezing for some products) throughout storage and transit. This unbroken temperature control is known as the cold chain. If the cold chain fails at any point – for instance, a freezer malfunction during shipping or improper refrigeration at a warehouse – the affected medicines can degrade or lose potency, rendering them ineffective or unsafe. In fact, industry analyses estimate that over a quarter of some vaccines may be wasted globally each year due to temperature control and logistics failures. Effective cold-chain management requires specialized freezers, insulated packaging, continuous temperature monitoring, and trained handlers. Even with these measures, global distribution of temperature-sensitive drugs (such as during the COVID-19 vaccine rollout) has highlighted gaps in cold-chain capacity, especially in low-resource settings. Maintaining product safety means companies must invest in robust cold-chain infrastructure and backup plans. Failure to do so can lead to product spoilage and, more critically, pose direct health risks to patients relying on those medications.

Counterfeit and Substandard Drugs: Another major challenge is keeping fake or compromised products out of the supply chain. The pharmaceutical sector is unfortunately a target for counterfeiters, who may attempt to introduce look-alike drugs that contain incorrect or no active ingredients. These fake medicines can cause treatment failures or harmful effects, undermining patient trust and public health. Globalization and the rise of online pharmacies have increased the complexity of this threat. Supply chain visibility and verification are key to fighting counterfeit drugs. Measures such as serialization (assigning unique codes to each product unit) and verification scans at each transfer point help authenticate products. Regulatory initiatives like the DSCSA in the US and the EU Falsified Medicines Directive require pharmacies and distributors to verify drug packages, making it harder for illegitimate products to slip in. Encouragingly, these efforts are critical because recent data show the scope of the problem: nearly 7,000 counterfeit drug incidents were documented worldwide in 2023 – a 4% rise from the previous year (Jain, 2024). Many companies now also partner with organizations like the Pharmaceutical Security Institute and Interpol to track and intercept counterfeit shipments. In addition to technology, tamper-evident packaging, employee training, and consumer education (e.g. identifying authentic packaging or using authorized pharmacies) are all parts of a comprehensive counterfeit prevention strategy. Ensuring the integrity of the supply chain against fake drugs is an ongoing battle that requires vigilance and international collaboration.

Apart from cold chain and counterfeiting, the industry also grapples with other challenges: managing drug shortages and demand fluctuations, coordinating across multiple suppliers and geographies, and dealing with complex regulations in different markets. Each of these issues can disrupt the smooth flow of medicines if not proactively managed. Building a resilient pharmaceutical supply chain means anticipating such risks and implementing safeguards – whether that’s maintaining safety stock, qualifying multiple suppliers for critical raw materials, or enhancing real-time visibility into inventory across the network.

Supply Chain Technology: Automation, Traceability, and Resilience

To address these challenges and improve efficiency, pharmaceutical companies are increasingly investing in modern supply chain technology. The goal is to create a smarter, more visible and agile supply chain that can respond quickly while ensuring quality. Several key trends and innovations are shaping the future of pharma supply chains:

- Digital Track-and-Trace Systems: Advanced IT systems now enable end-to-end traceability of drug products. Using technologies like 2D barcodes, RFID tags, and blockchain ledgers, companies can monitor each shipment’s journey in real time. For example, a manufacturer can see when a batch leaves the plant, when it arrives at a wholesaler, and when it’s received by a pharmacy – with automated alerts if a package is delayed or if temperature sensors detect an excursion. This supply chain visibility helps companies react faster to issues (like recalling a specific lot or rerouting a shipment), and it strengthens security by verifying each handoff. In essence, digital traceability tools are like a tracking GPS for medicines, greatly reducing the chances of losing product or accepting counterfeit returns.

- Automation and AI: Automation is being adopted to streamline various supply chain operations. In warehouses, robotic systems and automated guided vehicles can manage inventory, pick orders, and pack shipments faster and with fewer errors than manual processes. On the planning side, artificial intelligence and machine learning algorithms are enhancing demand forecasting and inventory optimization. These tools analyze historical data, market trends, and even epidemiological patterns to predict where demand will surge or when a supply disruption might occur. According to a 2023 industry survey, one-third of biopharma companies are looking to scale up AI-driven capabilities (like machine-vision quality checks and digital twins for production) in the next five years (Pernenkil et al., 2024). Automation not only improves efficiency but also builds supply chain resilience by helping companies anticipate problems (e.g. a spike in demand or a supplier delay) and adjust proactively.

- Cold-Chain Monitoring Tech: To bolster cold chain reliability, new technologies are employed such as IoT-enabled temperature sensors and data loggers that travel with shipments. These devices continuously send temperature readings and location data to the cloud. If a pallet of vaccines starts getting too warm, the system can trigger alerts or route the shipment to a nearby refrigerated facility. Some companies have also started using phase-change materials and advanced insulation in packaging to extend how long products stay in the safe range without power. These innovations, combined with better planning (like using faster transport for long-distance vaccine shipping), are reducing cold-chain breaks and product loss.

- Blockchain and Security Technologies: In the fight against counterfeits, blockchain technology offers a tamper-resistant way to record transactions in the supply chain. By recording each transfer of custody on a decentralized ledger, blockchain can provide an extra layer of verification that a drug package is authentic and its history is transparent. Pilot programs by major pharma companies have shown promise in using blockchain for verifying high-value drugs. Other security steps include advanced holographic seals, forensic markers (like chemical or DNA taggants in products), and patient-facing tools (e.g. apps to verify a product’s code). While no single technology is foolproof, together these innovations significantly harden the supply chain against infiltration.

- Collaborative Platforms and Marketplaces: Recognizing that no company operates in isolation, the industry is also embracing more collaboration through digital platforms. Cloud-based supply chain management software allows manufacturers, distributors, and providers to share forecasts and inventory data, reducing information silos. Additionally, online marketplaces are emerging to connect stakeholders more efficiently. For example, Pharmaoffer – a Netherlands-based digital platform – initially digitized the sourcing of APIs and now hosts a growing roster of vetted contract service providers (such as CROs, Contract Research Organizations, and CDMOs) that users can compare and contact directly (Sternberg, 2024). By leveraging such platforms, pharma companies can more easily find trusted partners, whether it’s to outsource a production step or to source an ingredient during a shortage. This kind of connectivity and transparency ultimately strengthens the supply chain by widening the network of reliable suppliers and service options.

Overall, the infusion of technology is transforming pharmaceutical supply chains that were once paper-based and reactive into systems that are data-driven and predictive. Leaders in the field note that end-to-end digitalization of supply chain processes is fast becoming essential, not optional, for pharma companies to remain competitive and ensure patient needs are met. However, technology adoption also comes with challenges – such as integrating new tools into legacy systems and training staff – and surveys show many companies have yet to realize the full benefits of their investments. Even so, the trend is clear: embracing innovation, from automation to advanced analytics, is paving the way for more resilient and agile supply chain operations in the pharmaceutical sector.

Conclusion and Next Steps

The fundamentals of the pharmaceutical supply chain remain focused on one core mission: delivering safe, effective medicines to patients reliably and efficiently. By orchestrating every step – from procuring quality raw materials and rigorously manufacturing products, to maintaining control through distribution and final dispensing – the industry works to ensure that a patient can trust the medicine in their hand. As we have seen, this supply chain is complex and not without vulnerabilities. Strict quality assurance, robust cold chain logistics, and vigilant counterfeit prevention are all indispensable to its integrity. Recent global events (like the COVID-19 pandemic) underscored the importance of supply chain resilience – prompting companies to diversify suppliers, build safety stocks, and invest in supply chain visibility so they can adapt to disruptions.

Looking ahead, continued collaboration and innovation will be key to strengthening the pharmaceutical supply chain. Manufacturers, regulators, distributors, and healthcare providers must remain aligned in their commitment to compliance and communication. At the same time, leveraging cutting-edge supply chain technology – from AI-driven planning to blockchain traceability – will help preempt issues and enhance efficiency. Every improvement in the supply chain ultimately means better outcomes for patients, whether that’s a vaccine reaching a remote clinic at the right temperature or a critical drug being in stock when a patient needs it.

Ensuring a smooth flow of medicines is a shared responsibility across the industry. For professionals seeking to fortify their supply chain strategies, it’s wise to stay informed on regulatory updates and emerging tools. It’s also beneficial to engage with platforms that facilitate connections to qualified partners. (Pharmaoffer, for instance, provides an online marketplace where you can explore vetted suppliers and contract service organizations to support various supply chain needs.) By focusing on transparency, agility and quality at every step, companies can build a more resilient pharmaceutical supply chain – one that consistently delivers on its promise to patients worldwide.

Sources:

- Fundamentals of the Pharmaceutical Supply Chain. PharmaNewsIntelligence – TechTarget.

- Digitalized supply chains are essential to biopharma’s future. Deloitte Insights.

- European Medicines Agency (EMA). (2022). Good Distribution Practice (GDP).

- U.S. Food & Drug Administration (FDA). (2025). Drug Supply Chain Security Act (DSCSA) – Overview.

- QodeNext. (2023). Tips to Improve Supply Chain in Pharmaceutical Industry in 2023.

- New technologies to combat counterfeit drugs. CAS Insights.

- JAF Consulting, Inc. (2023). The Importance of GMP and GDP: Ensuring Pharmaceutical Compliance.

- Sustainable cold chains needed for equitable COVID-19 vaccine distribution. Sustainable Energy for All.

- Pharmaoffer Expands Services to Combat Medicine Shortages. Contract Pharma News.

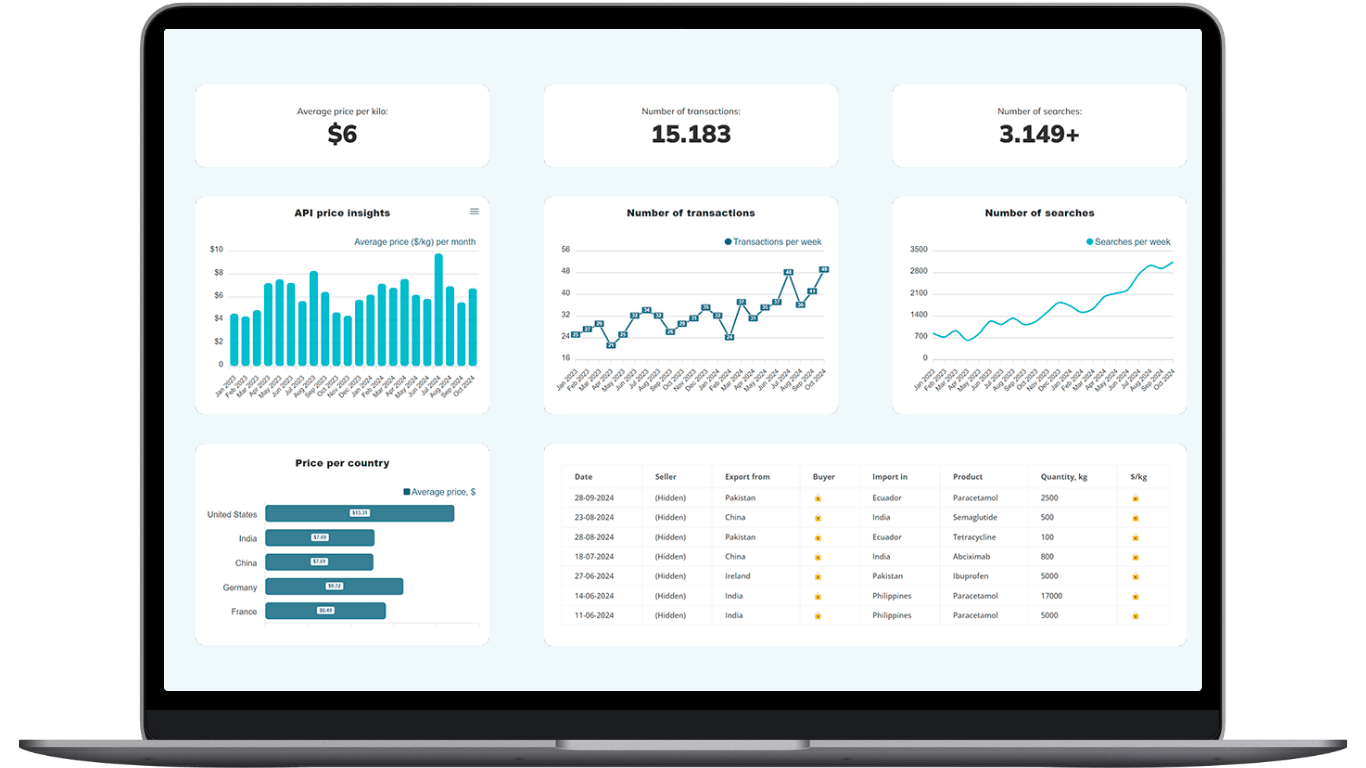

Make Smarter API Decisions with Data

Access exclusive insights on global API pricing, export/import transactions, competitor activities and market intelligence.

What are the main stages of the pharmaceutical supply chain?

The supply chain moves from raw material sourcing and manufacturing to distribution via wholesalers, then on to pharmacies, hospitals, and patients. Each stage requires strict quality assurance and regulatory compliance to keep products safe and effective.

Why is cold chain logistics crucial for medicines and vaccines?

Many biologics and vaccines must stay between 2–8 °C to preserve potency. A break in the cold chain can render a drug ineffective, so pharma companies rely on temperature-controlled packaging, real-time monitoring, and GDP-certified carriers.

How does digital traceability fight counterfeit drugs?

Serialization, RFID, and blockchain create end-to-end traceability that verifies each medicine’s origin and journey. These tools alert distributors to fake products and protect patient product safety by making counterfeits easier to detect and remove.

Which emerging supply chain technologies improve resilience?

AI-driven demand forecasting, warehouse automation, IoT sensors for condition monitoring, and blockchain for secure data sharing all enhance supply chain visibility and resilience, helping companies anticipate disruptions and act before shortages occur.

How can digital platforms support my pharmaceutical supply chain needs?

Pharmaoffer’s digital platform connects you with vetted API suppliers, CDMOs, and CROs, simplifying sourcing and compliance checks. Comparing multiple partners in one place saves time, improves supplier reliability, and strengthens overall supply chain efficiency.

Check out all other blogs here!